Which Search AI to Prioritize: A Strategic Guide for AI SEO in 2026

Last updated: December 2026 | Reading time: 15 minutes

In AI SEO, we're witnessing a hyper-fragmented market with numerous channels that require strategic prioritization. The landscape has exploded beyond a single platform: ChatGPT, Perplexity, Gemini, Claude, Grok, and Copilot each serve distinct user bases with different preferences, citation patterns, and optimization requirements.

The debate over whether AI SEO is "real SEO" or something entirely different has dominated industry discussions. Traditional SEO practitioners argue that AI search is just another channel requiring the same optimization principles. AI-first marketers counter that generative search represents a fundamental shift requiring entirely new strategies. Both perspectives miss a crucial point.

What we're actually seeing is something more fundamental: different channels that each prefer different content types. This isn't about whether AI SEO is "real SEO" or not. It's about recognizing that each AI platform has distinct preferences, citation patterns, and user expectations. Perplexity prioritizes citation-worthy sources with clickable links. ChatGPT favors comprehensive, Wikipedia-style content with clear structure. Gemini emphasizes real-time information and visual content. Claude values deep reasoning and long-form analysis. Grok connects to Twitter communities and social trends. Copilot integrates with Microsoft's enterprise ecosystem and B2B workflows.

This fragmentation means you can't optimize for "AI search" as a monolith. You need to choose which platforms align with your business goals, target audience, and content strategy. We have analyzed the traffic distribution and user demographics of each platform to get a deeper understanding of who uses which AI search tool and why. This article explains how to select the right LLMs based on what you're offering, who you're targeting, and which platforms will deliver the highest ROI for your specific use case.

The Six Major AI Search Platforms

Today's AI search ecosystem consists of six major platforms, each with distinct characteristics:

- ChatGPT (OpenAI) - The market leader with 400+ million weekly users

- Perplexity (Perplexity AI) - Citation-based research platform

- Gemini (Google) - Integrated into Google search and growing rapidly

- Claude (Anthropic) - Enterprise-focused with deep reasoning capabilities

- Grok (xAI) - Twitter-integrated, community-driven platform

- Copilot (Microsoft) - B2B and Microsoft ecosystem integration

ChatGPT Still Leads, But Competition Is Catching Up

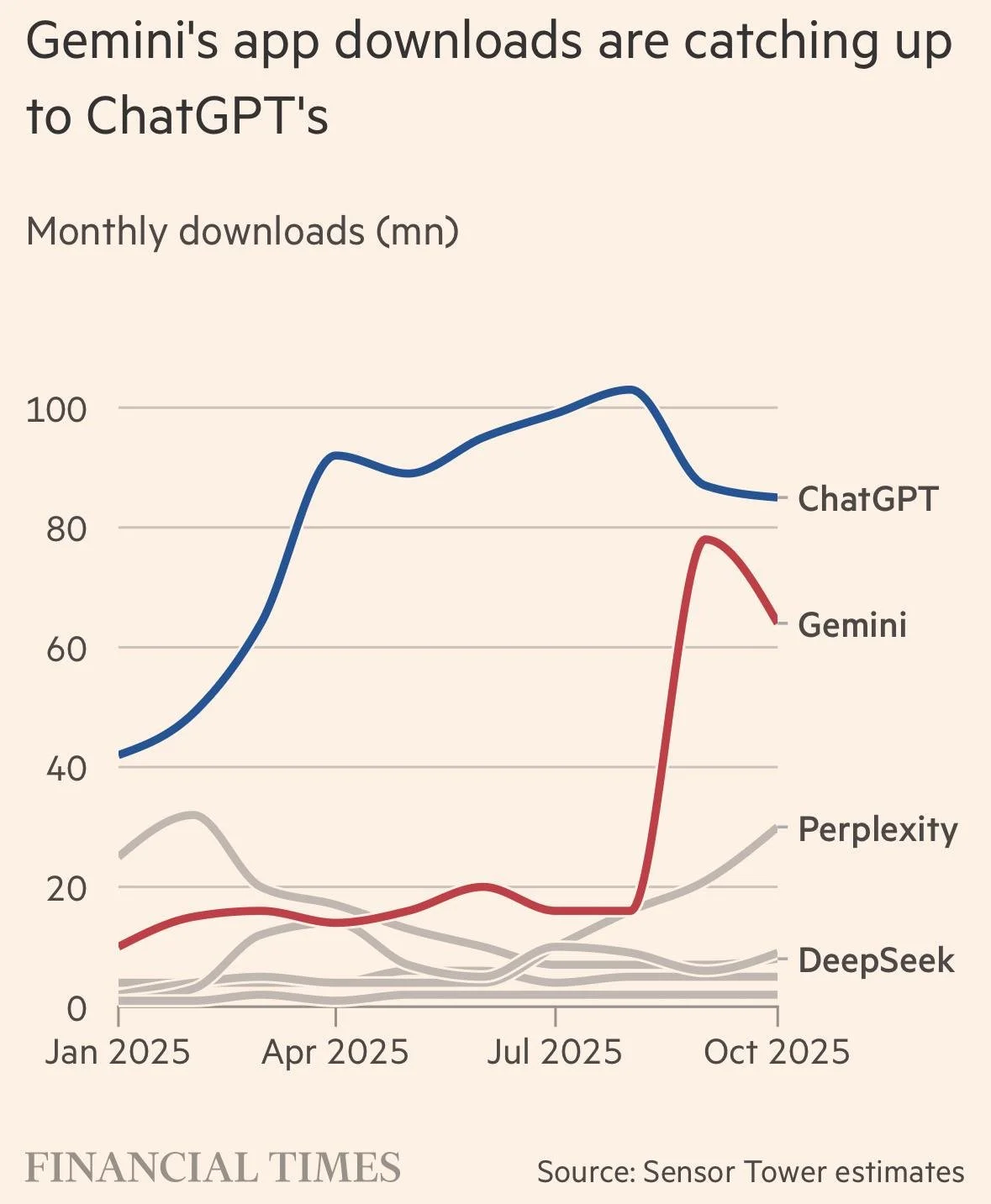

While ChatGPT remains the dominant platform, the competitive landscape is shifting rapidly. According to Financial Times data from Sensor Tower estimates, we can see that Gemini and Perplexity are catching up:

The data reveals a dramatic shift: Gemini experienced explosive growth from July to September 2026, peaking at nearly 80 million downloads and closing the gap with ChatGPT. Perplexity maintained steady growth, solidifying its position as the third most downloaded LLM app. This fragmentation means businesses can't rely solely on ChatGPT optimization. You need a multi-platform strategy that prioritizes platforms based on your specific audience and goals.

How to Choose: Platform-by-Platform Analysis

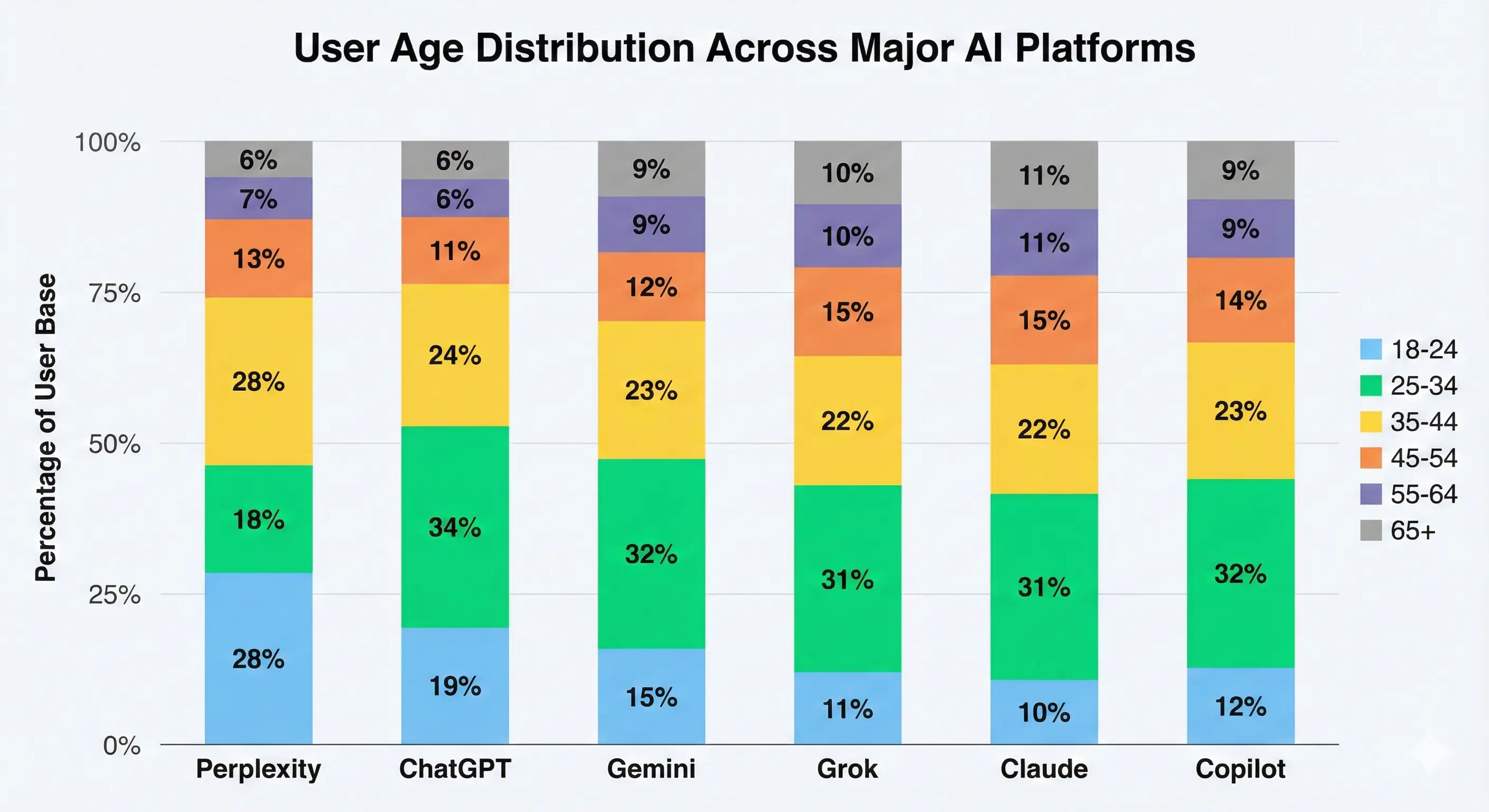

Each platform serves distinct user demographics and use cases. Understanding these differences is crucial for prioritizing your AI SEO efforts. The chart above illustrates how user demographics vary significantly across platforms, which directly impacts which industries should prioritize each platform. Below, we analyze each platform's user base, ideal industries, and optimization priorities.

1. ChatGPT: The Universal Platform

User Demographics: 62% female, 38% male. Age distribution: 28% (18-24), 18% (25-34), 28% (35-44), 13% (45-54), 7% (55-64), 6% (65+). 40% parents, 60% non-parents.

Who Uses It: General users, developers, content creators, students, creative professionals.

Best For: All-around tasks, brainstorming, coding, creative writing, workflow automation, versatile integrations.

Industry Fit: ChatGPT's balanced gender distribution and broad age range make it ideal for consumer-facing industries targeting general audiences. The high percentage of younger users (18-44) combined with a significant parent demographic (40%) creates opportunities for family-oriented and lifestyle brands.

Priority Statement: Industries like consumer goods, lifestyle brands, family services, education, and creative services, more focused on general consumer audiences and balanced gender demographics, should put more effort in showing up on ChatGPT.

Once you've identified ChatGPT as a priority platform, you'll need the right tools to track your brand's visibility. We've created a comprehensive guide to the best ChatGPT tracker tools that compares platforms, pricing, features, and reliability to help you select the monitoring solution that fits your needs.

2. Perplexity: The Research Platform

User Demographics: 40% female, 60% male. Age distribution: 19% (18-24), 34% (25-34), 24% (35-44), 11% (45-54), 6% (55-64), 6% (65+). 25% parents, 75% non-parents.

Who Uses It: Students, journalists, researchers, Q&A-focused teams, fact-checkers.

Best For: Factual research, source-backed answers, fact-checking, real-time information, visual searches, quick summaries.

Industry Fit: Perplexity's male-skewed audience (60%) and concentration in the 25-34 age group (34%) aligns with professional research and information-seeking behaviors. The low parent percentage (25%) suggests users are primarily focused on work, study, or personal research rather than family-oriented queries.

Priority Statement: Industries like B2B SaaS, research tools, academic resources, professional services, and technical documentation, more focused on professional researchers and information-seekers in the 25-34 age range, should put more effort in showing up on Perplexity.

Once you've identified Perplexity as a priority platform, you'll need the right tools to track your brand's visibility. We've created a comprehensive guide to the best Perplexity monitoring tools that compares platforms, pricing, features, and reliability to help you select the monitoring solution that fits your needs.

3. Gemini: The Tech-Savvy Platform

User Demographics: 46% female, 54% male. Age distribution: 15% (18-24), 32% (25-34), 23% (35-44), 12% (45-54), 9% (55-64), 9% (65+). 31% parents, 69% non-parents.

Who Uses It: Google ecosystem users, tech enthusiasts, early adopters, mobile-first users.

Best For: Google-integrated searches, real-time information, visual content, mobile queries, quick answers.

Industry Fit: Gemini's strong 25-34 demographic (32%) and tech-forward user base make it ideal for technology, innovation, and digital-native brands. The balanced gender split and low parent percentage suggest a younger, career-focused audience.

Priority Statement: Industries like technology products, digital services, mobile apps, innovation platforms, and tech media, more focused on tech-savvy audiences in the 25-34 age range, should put more effort in showing up on Gemini.

4. Claude: The Enterprise Platform

User Demographics: 35% female, 65% male. Age distribution: 11% (18-24), 31% (25-34), 22% (35-44), 15% (45-54), 10% (55-64), 10% (65+). 31% parents, 69% non-parents.

Who Uses It: Enterprises, academics, legal/compliance teams, safety-conscious organizations, researchers requiring deep analysis.

Best For: Handling long documents, deep reasoning, data analysis, complex problem-solving, ethical/policy-heavy work, enterprise applications.

Industry Fit: Claude's strong male demographic (65%) and concentration in professional age groups (25-44) aligns with enterprise and professional services. The platform's emphasis on safety, compliance, and deep reasoning makes it ideal for regulated industries and complex B2B services.

Priority Statement: Industries like enterprise software, legal services, compliance consulting, financial services, and professional consulting, more focused on enterprise buyers and professional decision-makers, should put more effort in showing up on Claude.

5. Grok: The Social Platform

User Demographics: 40% female, 60% male. Age distribution: 10% (18-24), 31% (25-34), 22% (35-44), 15% (45-54), 11% (55-64), 11% (65+). 29% parents, 71% non-parents.

Who Uses It: Social media enthusiasts, trend trackers, early adopters, Twitter/X power users, community-driven audiences.

Best For: Real-time X (Twitter) insights, trend spotting, unfiltered/opinionated responses, fun and casual conversation, social media analysis, community engagement.

Industry Fit: Grok's integration with Twitter/X and its community-driven nature makes it ideal for brands targeting social media-savvy audiences. The platform's connection to Twitter communities means it's particularly valuable for industries with strong social media presence and community engagement.

Priority Statement: Industries like social media tools, community platforms, creator economy, gaming, and entertainment, more focused on social media-savvy audiences and Twitter communities, should put more effort in showing up on Grok.

6. Copilot: The B2B Platform

User Demographics: 35% female, 65% male. Age distribution: 12% (18-24), 32% (25-34), 23% (35-44), 14% (45-54), 9% (55-64), 9% (65+). 28% parents, 72% non-parents.

Who Uses It: Microsoft ecosystem users, enterprise teams, B2B professionals, Office 365 users, Windows power users.

Best For: B2B workflows, Microsoft Office integration, enterprise productivity, business document analysis, professional collaboration.

Industry Fit: Copilot's deep integration with Microsoft's enterprise ecosystem and strong male demographic (65%) makes it ideal for B2B companies targeting enterprise buyers. The platform's focus on productivity and business workflows aligns with professional services and enterprise software.

Priority Statement: Industries like enterprise software, B2B services, Microsoft ecosystem products, professional productivity tools, and business consulting, more focused on B2B buyers and Microsoft enterprise users, should put more effort in showing up on Copilot.

Key Takeaways: It's Not About Finding One "Best" AI

The most important insight from this analysis is that there's no single "best" AI platform. Each platform serves distinct user bases with different needs, demographics, and use cases. Your prioritization strategy should depend on:

- Your target audience demographics: Match platform demographics to your customer base

- Your industry vertical: Some platforms naturally align with specific industries

- Your content type: Research-heavy content fits Perplexity; creative content fits ChatGPT

- Your business model: B2B companies should prioritize Claude and Copilot; B2C brands should focus on ChatGPT and Gemini

- Your integration needs: Microsoft users need Copilot; Twitter communities need Grok

Strategic Prioritization Framework

Based on the platform analysis above, here's a practical framework for prioritizing your AI SEO efforts:

For Consumer Brands

Primary: ChatGPT (universal reach, balanced demographics)

Secondary: Gemini (tech-savvy consumers, mobile users)

Tertiary: Perplexity (research-oriented consumers)

For B2B Companies

Primary: Claude (enterprise focus, deep reasoning)

Secondary: Copilot (Microsoft ecosystem, B2B workflows)

Tertiary: Perplexity (professional research)

For Research-Heavy Industries

Primary: Perplexity (citation-based, source-focused)

Secondary: Claude (deep analysis capabilities)

Tertiary: ChatGPT (general research queries)

For Social Media-Focused Brands

Primary: Grok (Twitter integration, community-driven)

Secondary: ChatGPT (general social queries)

Tertiary: Gemini (mobile-first social users)

Frequently Asked Questions

Which AI search platform should I prioritize for my business? ▼

The best AI platform depends on your target audience and industry. ChatGPT suits general audiences and creative industries. Perplexity works best for research-heavy industries and fact-checking. Gemini appeals to younger, tech-savvy audiences. Claude is ideal for enterprise, legal, and compliance-focused businesses. Grok targets social media-savvy audiences and Twitter communities. Copilot serves B2B and Microsoft ecosystem users.

Is ChatGPT still the dominant AI search platform? ▼

Yes, ChatGPT remains the market leader with 400+ million weekly users. However, Financial Times data shows Gemini and Perplexity are rapidly catching up, with Gemini experiencing dramatic growth and Perplexity maintaining its position as the third most downloaded LLM app. The market is fragmenting, making multi-platform optimization essential.

Should I optimize for multiple AI platforms? ▼

Yes. The AI search market is hyper-fragmented with distinct user bases and use cases. Most businesses should prioritize 2-3 platforms based on their target demographics and industry, but comprehensive AI SEO requires visibility across multiple channels. Start with platforms that align with your primary audience, then expand to secondary platforms as resources allow.

How do user demographics differ across AI platforms? ▼

User demographics vary significantly. ChatGPT has a balanced gender split (62% female) with broad age distribution. Perplexity skews male (60%) and younger (34% are 25-34). Gemini appeals to tech-savvy users (32% are 25-34). Claude targets enterprise users (65% male, professional age groups). Grok connects with social media communities (60% male, Twitter-focused). Copilot serves B2B professionals (65% male, Microsoft ecosystem users).

What's the difference between AI SEO and traditional SEO? ▼

Traditional SEO optimizes for search engine results pages (SERPs) with clickable links. AI SEO optimizes for AI-generated answers that may or may not include citations. The key difference is that AI platforms have distinct preferences: Perplexity provides clickable citations, ChatGPT offers conversational responses, and each platform favors different content structures. However, both require quality content, domain authority, and strategic optimization.

How do I know which platform my target audience uses? ▼

Match platform demographics to your customer base. If you target general consumers with balanced demographics, prioritize ChatGPT. For professional researchers and B2B audiences, focus on Perplexity and Claude. Tech-savvy younger audiences align with Gemini. Social media-focused brands should prioritize Grok. Microsoft enterprise users need Copilot. Use tools like Sellm to track your brand's visibility across platforms and identify where your audience is most active.

Can I use the same content strategy across all AI platforms? ▼

No. Each platform has distinct content preferences. Perplexity requires citation-worthy sources with authoritative links. ChatGPT favors Wikipedia-style comprehensive content. Gemini emphasizes real-time information and visual content. Claude values deep analysis and long-form reasoning. Grok connects to social trends and Twitter communities. Copilot integrates with business workflows. While core content quality matters across all platforms, optimization tactics must be platform-specific.

How often should I review my AI platform prioritization? ▼

Review your platform prioritization quarterly. The AI search landscape changes rapidly, with new platforms emerging and user demographics shifting. Monitor your brand's visibility across platforms monthly, track which platforms drive the most qualified traffic, and adjust your strategy based on performance data. Financial Times data shows platforms like Gemini can experience rapid growth, so staying flexible is essential.

Conclusion: Embrace the Fragmentation

The AI search market's fragmentation isn't a problem to solve. It's an opportunity to optimize. By understanding each platform's unique user base, use cases, and optimization requirements, you can create targeted strategies that deliver higher ROI than a one-size-fits-all approach.

Start by identifying which platforms align with your target demographics and industry. Then prioritize 2-3 platforms for focused optimization efforts. Remember: comprehensive AI SEO requires visibility across multiple channels, but strategic prioritization ensures you're investing resources where they'll have the greatest impact.

Ready to track your brand's visibility across these platforms? Try Sellm's free AI search audit to see how your brand performs across ChatGPT, Perplexity, Gemini, Claude, Grok, and Copilot.